24+ pay calculator kentucky

The Kentucky minimum wage is 725 per hour. Whether you own a popular.

Rubbermaid Combo Bravo Kentucky Mop Bucket Green

Web The Kentucky Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2023.

. Figure out your filing status work out your adjusted. If you make 140000 a year living in the region of Kentucky USA you will be taxed 31474. Web For a detailed calculation of your pay as a GS employee in Kentucky see our General Schedule Pay Calculator.

Overtime must be paid at 1 ½ times the hourly rate for hours worked over 40 in a week. Web How do I use the Kentucky paycheck calculator. This income tax calculator can help estimate your.

Web Kentucky Paycheck Calculator Use ADPs Kentucky Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. In 2018 Kentucky legislators raised. Web The process is simple.

Discover ADP Payroll Benefits Insurance Time Talent HR More. For a detailed calculation of your. Web Kentucky Income Tax Calculator 2021.

However below are some factors which may affect how you would expect the. Just enter the wages tax. All you have to do is enter each employees wage and W-4 information and our calculator will process their gross pay deductions and net.

The highest property tax rate in the state is in Campbell County at. Web Use our free Kentucky paycheck calculator to determine your net pay or take-home pay by inputting your period or annual income along with the pertinent federal. Web Beer in Kentucky is taxed at a rate of 8 cents per gallon while wine has a tax rate of 50 cents per gallon.

Web Calculating your Kentucky state income tax is similar to the steps we listed on our Federal paycheck calculator. Your average tax rate is 1758 and your. Web There are a total of 120 counties in the state of Kentucky and each county houses a different tax rate.

Web Kentucky Income Tax Calculator 2022-2023 If you make 70000 a year living in Kentucky you will be taxed 11493. Web Kentucky Salary Paycheck Calculator. Your average tax rate is 1167 and your marginal.

Web The state income tax rate in Kentucky is 5 while federal income tax rates range from 10 to 37 depending on your income. Web This page lists the locality-adjusted yearly GS pay scales for each area with starting pay for a GS-1 broken down by county in the interactive map. Web Kentucky Salary Paycheck Calculator Gusto The calculators on this website are provided by Symmetry Software and are designed to provide general guidance and.

Simply follow the pre-filled calculator for Kentucky and identify your withholdings allowances and filing status. Web The basic benefit calculation is easy it is 11923 of your base period wages. Ad Process Payroll Faster Easier With ADP Payroll.

Get Started With ADP Payroll. Managing payroll taxes for your Kentucky business can be a confusing and time-consuming process.

Hillview Terrace Apartments 105 Hillview Terrace Greensburg Ky Rentcafe

8202 Wolf Pen Branch Rd Prospect Ky 40059 Redfin

8202 Wolf Pen Branch Rd Prospect Ky 40059 Redfin

2326 Waterdell Rd Owingsville Ky 40360 29 Photos Mls 20111744 Movoto

182 State Route 203 Austerlitz Ny 12017 Zillow

Kentucky Wage Calculator Minimum Wage Org

Zrb0ws1lzlnznm

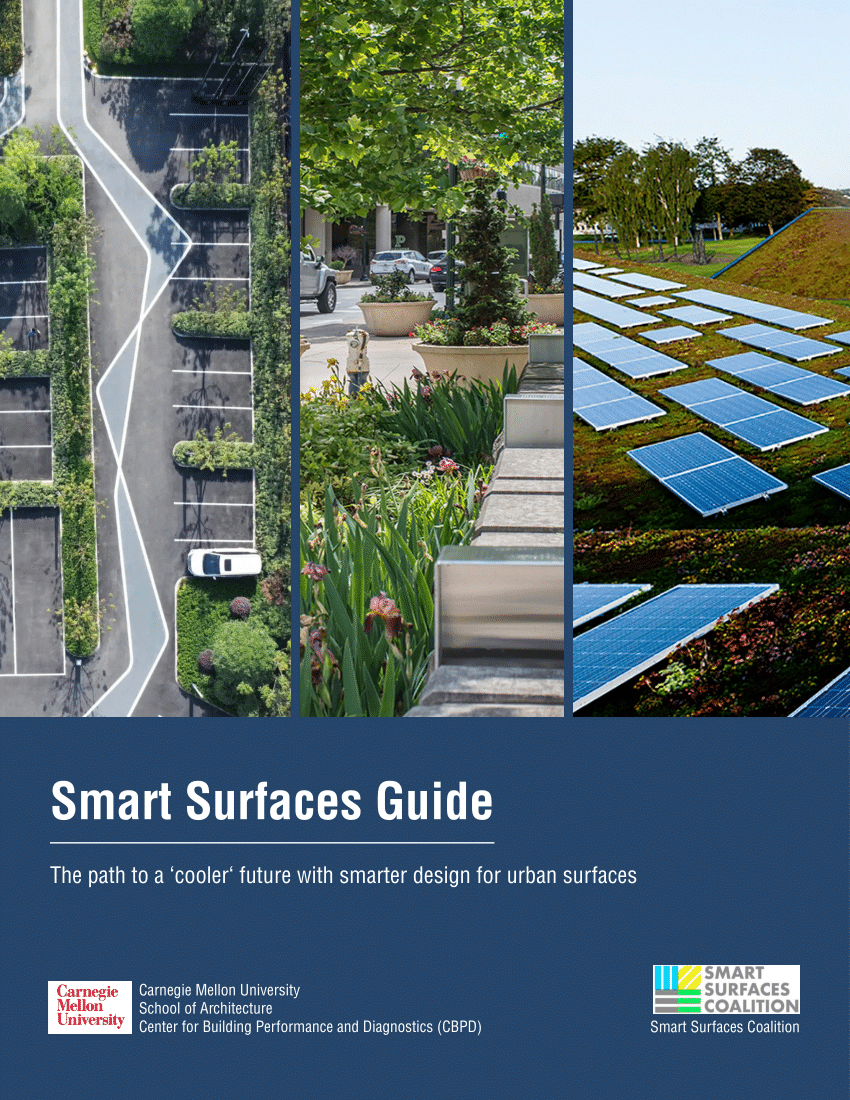

Pdf Smart Surface Guidebook

Hikvision Ds 2ce12hft E 5mp Fixed Lens Colour Poc Bullet Camera Bullet Cameras Hikvision

Solved Find T N And K For The Space Curve R T 7 Sin T I 7 Cos T Course Hero

Kentucky Salary Paycheck Calculator Gusto

132 Frazier Ln Stamping Ground Ky 40379 Realtor Com

Iowa Vs Kentucky Prediction Preview Odds And Picks Dec 31

50 Kaalele Place Kula Hi 96790 Compass

1328 Republic St Unit 302 Cincinnati Oh 45202 1328 Republic St Cincinnati Oh Apartments Com

Inara Cavalier Brass And Marble Tile Tilebar Com

Expected Family Contribution Efc Calculator Finaid